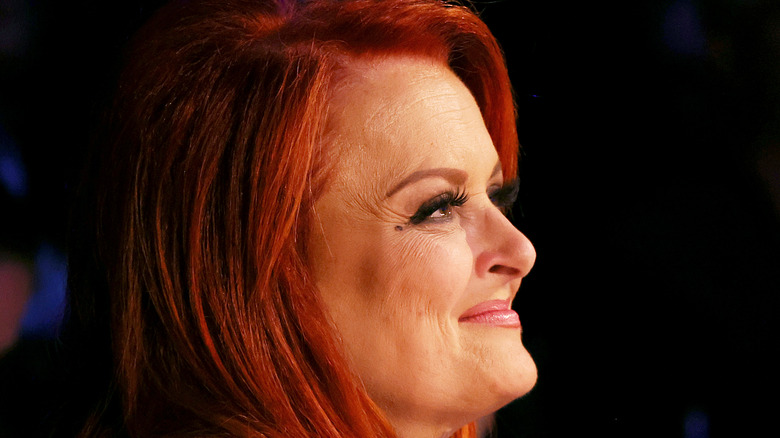

How Wynonna Judd Almost Lost All Of Her Money

This article contains mentions of suicide and sexual abuse.

Fans of the Judd family may already be well-aware of their numerous personal issues and tragedies. In April, for instance, Naomi Judd tragically ended her own life after succumbing to a lifelong battle with depression.

The other half of the iconic country duo The Judds – Wynonna Judd — has undergone her own share of personal turmoil, even before she lost her mother. After losing her biological father before she ever got the chance to meet him, Wynonna has gone through several well-publicized struggles, including getting married thrice and divorced twice (one of which was after she discovered her husband sexually assaulted a child) and dealing with addiction — both firsthand (to food) and secondhand (through her daughter's addiction to methamphetamine).

However, what many fans of the Kentucky-born singer may not know is that there is yet another troubling personal conflict Wynonna has had to overcome: a spending problem, one which almost led her to the loss of almost all of her hard-earned money.

Wynonna Judd developed a debilitating spending problem

Naomi Judd initially raised her daughters Wynonna and Ashley Judd in poverty. Per ABC News, the family consistently wore second-hand clothing and often lived without electricity or even indoor plumbing. It would stand to reason, then, that finding success as a teenager made Wynonna feel like she "won the lottery," as she told The New York Times in 2008. Considering the fortune the Judd family achieved through their success, they practically did. However, that incredible fortune was almost squandered due to Wynonna's money mismanagement.

"I traveled, I took friends, I rented jets," the singer said about her spending problem in a 2010 episode of "Good Morning America," per ABC News. "I loved the great rock star lifestyle." As the Times reported, she even "[threw] money at her children out of guilt for missing hockey practices." After realizing she had almost lost all of her money, she understood that she only had one choice: get her spending habits under control, and treat it like an addiction. However, like any addiction, it was never as simple as quitting cold turkey. In fact, she even had to check herself into a treatment center.

Wynonna Judd went to spending rehab

It was around 2004 that Wynonna Judd decided once and for all to check herself into a treatment facility. According to The New York Times, the facility was a Nashville-based clinic called Onsite, and was run by a psychiatrist and life coach named Ted Klontz, with whom Judd worked to treat her spending issues. Onsite is meant to help treat those with problematic money behaviors who fall just short of diagnosable disorders, such as gambling or compulsive buying (which are generally treated at more traditional rehabilitation centers).

At the time, the price of Onset was just under $3,000 and involved six days of group therapy and financial counseling. "It literally like blew the doors wide open to possibilities I had never experienced before," Judd told Recovery Living Magazine about the beginning of her time at Onsite. "And I've done it all — literally. I've been on this journey to self-discovery for some time."

Now, despite the numerous other tragedies her family has endured, Judd has at least avoided losing all her money. By 2008, per The Times, she was in "absolute financial recovery," telling the outlet, "I live by cash only, by cash budget. I'll go into Target with a money envelope." And there's no doubt that her perseverance could serve as a lesson to anyone fighting their own demons. "If I can do it," she said of defeating her addiction," anyone can."