Celebrities Who Have Been Convicted Of Tax Fraud

Celebrities really seem to have it all — money, fame, and the adoration of loyal fans. But even though their massive earnings seem to position them in a completely different world to the rest of us, there's one thing that they can't escape ... paying taxes. And those record fortunes usually mean they have some pretty high amounts due to Uncle Sam. After all, like the late, great The Notorious B.I.G. once said, "Mo' money, mo' problems."

Such high earnings make famous faces susceptible to having their taxes audited. As noted by NBC News, the lifestyles of the rich and famous can attract additional attention from the IRS — and external circumstances like sporadic pay cycles and mishandled financial advice can lead a celebrity astray on their end-of-year filings.

Unfortunately for them, the IRS doesn't care what television series you star in or how many blockbuster flicks you've been a part of. Many celebrities have been convicted of tax fraud over the years, from reality stars and successful rappers to media moguls and movie stars. We're rounding up some of these big names and breaking down their offenses.

Mike Sorrentino

Reality stars seem particularly susceptible to tax troubles, so we're kicking off with "Jersey Shore" star Mike Sorrentino, better known as "The Situation." The Staten Island-born star rose to fame in 2009 with the debut of the addictive MTV reality series, which ran until 2012. Two years after the show ended, the star was indicted on charges that he had avoided paying taxes on $8.9 million in income. Per Forbes, both Mike and his brother, Marc Sorrentino, were accused of having filed false tax returns, and of having committed fraud. They were also alleged to have used their companies to evade taxation, using company money for personal expenses like expensive cars and clothing, and claiming them as legitimate business expenses.

In January 2018, he pleaded guilty to the charges, and he was sentenced to eight months in federal prison. A few months later, he shared his thoughts on his approaching jail time with Us Weekly. "We're taking it one day at a time right now," he explained. "We're really hoping for a positive outcome and you know, I worked so hard on myself the past couple years to turn a negative situation into a positive one, so I feel that when that day comes, I'll be ready for it."

Mike started his sentence a year after pleading guilty and was freed eight months later. Aside from the jail time, the reality star was also sentenced to two years of supervised release, a $10,000 fine, and 500 hours of community service.

Ja Rule

Long before he was involved in the infamous Fyre Festival debacle, Ja Rule got himself involved in a different kind of scandal ... one of the tax fraud variety. In March 2011, the rapper pleaded guilty to three counts of failing to file a tax return and agreed to pay over $1.1 million in tax debts, plus added penalties.

Prior to his sentencing, the star suggested that he had already paid millions in taxes, and had simply fallen short. "I owed them a little bit more," he confessed on "MTV's RapFix Live" (via Rolling Stone). He was sentenced to 28 months in prison for the offense but actually served more time. That period was tacked on to a two-year sentence he was already facing for a 2007 weapons charge. He was eventually released from prison two months earlier than his anticipated July 2013 release

Sadly, Rule's tax trouble didn't end there. In 2021, the rapper and his wife, Aisha Atkins, were accused of refusing to pay more than $3 million in federal taxes, according to Radar. The money in question was reportedly owed from the years 2005 through 2010 and 2012 through 2017. Naturally, one of Rule's most famous foes, 50 Cent, took the opportunity to poke fun at the situation on Instagram (via Complex). Sharing a screenshot of the Radar report, he wrote, "You gotta pay your taxes fool," along with some laughing emojis.

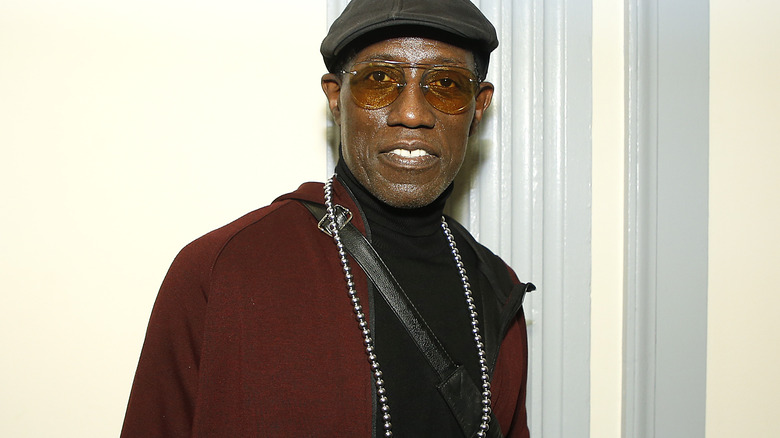

Wesley Snipes

In the '90s, Wesley Snipes found massive success in Hollywood with films like "White Men Can't Jump," "Demolition Man," and "Rising Sun." Unfortunately, the actor seemingly didn't file taxes after 1998. Per Fox News, the government claimed he made around $13.8 million during that time and racked up at least $2.7 million in back taxes. Per People, in 2008, the actor was convicted of three counts of willfully failing to file tax returns and handed a three-year sentence. He was also fined $5 million for failing to file taxes, though at that time he was acquitted of five additional charges that included tax fraud and conspiracy. In 2010, an appeal he'd submitted against the charges was denied and he entered federal prison that December.

During an appearance on "Larry King Live" that same year, Snipes suggested he felt his case had been mistreated by the media. "They claimed that there was a certain number that was owed and that number has been all over the place," he insisted. "The press has escalated it and changed it a number of times. But we think we are fully compliant with what was owed. Not only did I pay but my position is that I always paid." He ended up doing a little over two years of that sentence and was released in April 2013. Seven years later, he told The Guardian that his experience in jail gave him a new appreciation for spending time with loved ones.

Stephen Baldwin

In December 2012, the youngest brother of the Baldwin acting dynasty, Stephen Baldwin, was arrested and charged with failing to pay his taxes. He pleaded not guilty at the time of his arrest. The actor was alleged to have amassed a $350,000 debt after neglecting to pay New York state taxes for three years, from 2008 through to 2010.

Per CNN, three months later, the actor eventually pleaded guilty and fessed up to having failed to file his taxes for three years. However, in a statement given while leaving court, he attempted to provide some explanation for his wrongdoings. "Unfortunately, I got some really bad suggestions and advice ... from lawyers and accountants," the actor shared, adding that he was excited to get his debt paid off.

Surprisingly, although he faced up to four years in prison, Baldwin's plea deal didn't require any jail time. Instead, he had to pay $300,000 in back taxes, dodging the interest and penalty fees that would have made him liable for $400,000. The actor paid off the last of his debts in April 2014, a month before he found himself in trouble with the law again – this time for driving with a suspended license.

Fat Joe

Fat Joe began his rise to fame in the '90s, making a name for himself on the rap scene. Unfortunately, by 2012, he'd started making headlines for something other than hit songs when he pleaded guilty to tax evasion. Per The Hollywood Reporter, the musician had reportedly made almost $3 million in just two years and was found to subsequently owe over $700,000 in unpaid taxes to the federal government.

At the time, his defense attorney, Jeffrey Lichtman, told the New York Post, "Fat Joe has taken responsibility for his tax failures. He hopes to repay his tax indebtedness." Six months later, the rapper was sentenced to four months in prison for tax evasion and served time between August and November 2013, per Complex. Six years later, he reflected on how his penalty made him reevaluate his prior beefs, telling "The Breakfast Club," "I knew when I came out of jail I had to squash my s*** with JAY-Z. Squash my s*** with 50 Cent and any loose ends I had out there."

Lauryn Hill

In June 2012, singer Lauryn Hill — best known for her work with the hip-hop group, the Fugees, before going solo — was charged with failing to file over three years of income taxes. Per MTV, the IRS estimated she'd earned more than $1.6 million within that period. The following month the musician pleaded guilty to three counts of failing to file tax returns.

Hill was sentenced in May 2013, and she was very vocal with the judge about her case. Per CNN, the star pointed out the amount of money her music had made for other people and insisted that she lived modestly, by comparison. "This wasn't a life of jet-setting glamour. This was a life of sacrifice with very little time for myself and my children," she stated.

The singer famously addressed her legal troubles in a lengthy diatribe on Tumblr, in which she continued to plead her case about living a humble lifestyle. Hill added that she made a conscious decision to step away from the mainstream after experiencing a crisis that made her feel devalued by the industry and belittled by the media. "I abandoned greed, corruption, and compromise," she noted. "Never you, and never the artistic gifts and abilities that sustained me."

She was given a three-month prison stint alongside three months of house arrest. Additionally, she was also asked to pay what she owed on top of a $60,000 fine. The singer served her time and was released a few days early in October 2013.

Joe Giudice

"The Real Housewives of New Jersey" star, Joe Giudice, found fame alongside his wife, Terese Giudice, on the popular Bravo series when it debuted in 2009. Unfortunately, the spotlight exposed some information that the Jersey-based couple likely didn't want to share. Per USA Today, the Giudices were indicted in 2013 on a whole host of charges, including conspiracy to commit mail and wire fraud, bank fraud, bankruptcy fraud, and making false statements on loan applications. On top of those fraud charges, Joe also failed to file tax returns from 2004 through 2008. He was alleged to have earned almost $1 million during that period.

The couple both received prison sentences, with Teresa getting 15 months and Joe receiving 41 months. He reported for his sentence in March 2014 and was sentenced to be deported to his native Italy in October 2018 after attempting to appeal the decision three separate times, per People.

In 2020, Joe got candid about his legal troubles with E! News, sharing, "Look, everybody makes mistakes. I did what I had to do. I spent a lot of time in prison. People kill people and get that kind of time, you know what I mean? I just think it was a little too harsh, the sentence. I think they could have been a little lenient and they could have still made a point."

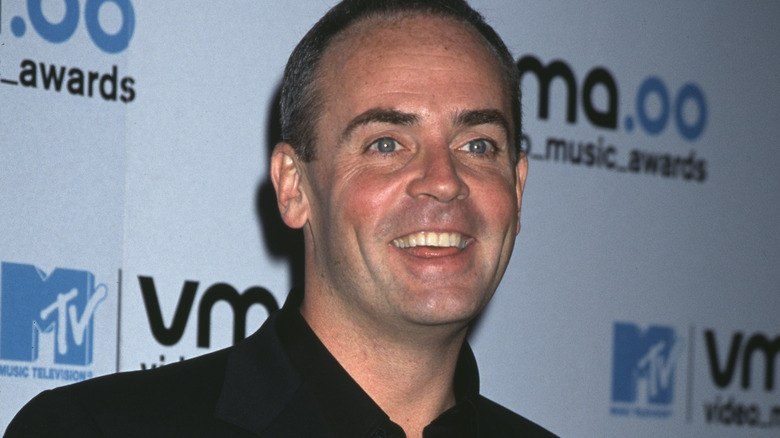

Richard Hatch

Remember the very first "Survivor" winner, Richard Hatch? Aside from being famous for walking around in the buff while cameras rolled during the show's inaugural 2000 season, he is otherwise best known for the legal troubles he found himself in after winning the one-million-dollar prize.

In January 2006, the reality star was found guilty of tax evasion and filing false tax returns. Naturally, some of the money in question that he failed to pay taxes on was his substantial "Survivor" earnings. However, aside from his winnings, he was also convicted of evading taxes on rent he made from a property he owed and his salary from co-hosting a radio show in Boston and was sentenced to 51 months in prison.

While he was in prison in 2007, he spoke to Oklahoma's News on 6 and maintained that he'd committed no wrongdoing. "I'm an innocent man in jail," he insisted. "... I don't apologize for anything. I didn't do anything wrong.” Per Daily News, he served time until 2009, and then received three years of supervised release. In 2011, he returned to prison for a nine-month sentence for failing to file and pay his outstanding taxes. Speaking to Forbes a year later, he claimed that he was unable to file an amended return due to the ongoing criminal investigation against him — this requirement was eventfully dropped. He also suggested that he was still awaiting a final bill from the IRS so he could capably pay off his debt.

Joe Francis

"Girls Gone Wild" became part of pop culture beginning in 1997 when creator Joe Francis launched the adult entertainment franchise. The videos often featured college-aged girls flashing the camera, and were wildly popular thanks to the ubiquitous late-night infomercials promoting them. The entrepreneur made a fortune in the process but eventually found himself in some serious trouble with the IRS.

In April 2007, Francis was indicted for tax evasion after deducting over $20 million from corporate income tax returns. He did 301 days of jail time, before pleading guilty to two counts of filing false tax returns and one count of bribing jail workers in Nevada in exchange for food, according to The Mercury News. But, his legal troubles didn't end there. In 2009, TMZ reported that the IRS filed a massive lien against the "Girls Gone Wild" creator, to the tune of over $33 million. The money in question was a result of back taxes from 2001 until 2003. He would go on to file for bankruptcy four years later.

According to a 2015 report by The Wall Street Journal, Francis is said to live in exile in Mexico. He is reportedly unable to return to the United States due to an active warrant for his arrest for failing to turn over two luxury cars during a bankruptcy case in 2014.

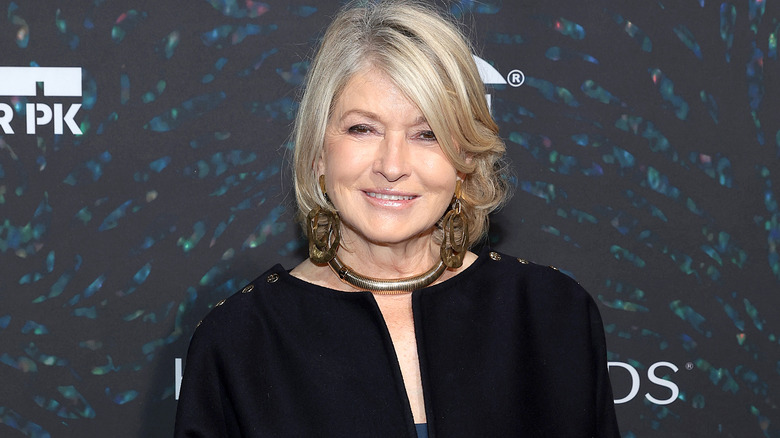

Martha Stewart

Most people are familiar with media mogul, Martha Stewart's legal troubles involving insider trading in 2004, but the icon has also found herself in some tax trouble, too. This time, it involved a complicated case where Stewart owed taxes to the state of New York. According to The New Yorker, the star's main residence — and site of many a photo shoot in her Martha Stewart Living magazine — happened to be in Westport, Connecticut. However, she also owned two properties in New York in the '90s — a cottage in East Hampton and an apartment in Manhattan. Stewart didn't deny owning property in the state in 1991 and 1992. Instead, she claimed that neither was a permanent residence and that both dwellings were undergoing renovations that rendered them uninhabitable.

When Stewart was eventually tried for tax evasion years later in 1998, she was unable to deny residency due to some surprising pieces of evidence. For starters, the jacket copy for her books published in those years read, "Mrs. Stewart lives in Connecticut and New York." Further damning were photographs of both properties in her own magazine that satisfied the judge as to them being fully furnished, habitable, and lived in. Per The New York Times, it was eventually ruled that she pay back over $200,000, plus penalties and interest. Stewart reportedly paid that figure back in full.

Willie Nelson

Country legend, Willie Nelson, got himself into so much trouble with the IRS he had to put out an entire album to help repay the debt! As reported by The New York Times, back in 1990, the free-spirited musician was found to have accrued a tax debt estimated to be around $32 million — the largest ever owed by an individual at that time. He subsequently had multiple properties and belongings like touring equipment, master tapes, and gold and platinum records seized by federal agents, according to Rolling Stone.

After his assets had been taken into possession, the IRS charged him a debt of $16.7 million. By 1993 that figure was brought down to $9 million, and after paying $3 million of that debt off, he decided to put out a two-disc collection to help pay the rest off. "The IRS Tapes: Who'll Buy My Memories," was released in 1992, and was pieced together from 35 years worth of seized recordings that the IRS gave him access to.

In 1995, Nelson reflected on the experience with surprisingly fond memories. "Mentally it was a breeze," he told Rolling Stone. "[The IRS] didn't bother me, they didn't come out and confiscate anything other than that first day, and they didn't show up at every gig and demand money. I appreciated that. And we teamed up and put out a record."

Toni Braxton

Power vocalist, Toni Braxton, made it big in the R&B world in the '90s, with songs like "Un-Break My Heart," and "Breathe Again." Sadly, over the years she found herself in trouble with the IRS not once, but twice. In 2018, The Blast reported that the star owed over $700,000 to the IRS and the state of California after four tax liens were filed against her.

A year later, she was again revealed to owe a massive amount of back taxes with E! News reporting that the IRS had filed a lien against the star for over $340,000. Meanwhile, the state of California had filed its own tax lien against Braxton for $116,000. The almost half-a-million dollars that Braxton reportedly owed were dated back to 2017, which the outlet noted was a financially successful year for the singer — the performer had finished out her The Hits Tour, while starring on the reality series, "Braxton Family Values." As of this writing, it's unclear how much of her debts the star has currently paid off.

Sadly, financial issues are nothing new for Braxton as the star has filed for bankruptcy twice in her life, firstly in 1998 and again in 2010. Two years after her second bankruptcy filing, she told "20/20" (via ABC News) that while she was prone to overindulgence, the nature of her early record contracts also left her with little to live off.